By Clint Gharib, AIF®, CFEd®

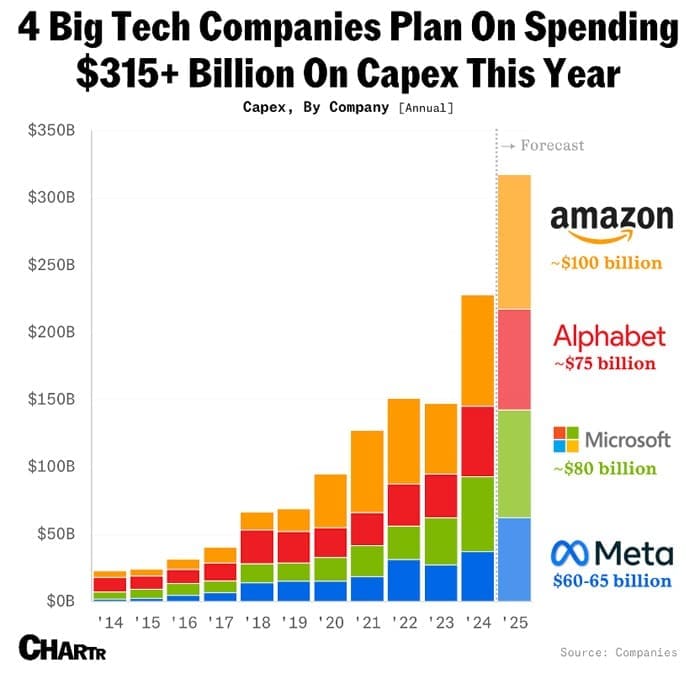

So far this year alone, we have had “experts” cry wolf over the Deep Seek announcement, then they cried wolf over the 2025 Trump tariffs, and recently they cried wolf that Nvidia’s Q2 earnings beat, and raise is not enough. Insert me slapping my forehead again. Just as I cautioned during the first two panics that they were being overdone and too many were misreading the data, I find myself here again. Consider this, if I told you that my business may lose the second biggest market I export to, but you were still expecting some sales still to that market in your estimates, but my sales and profit without any sales to that market ended up being even better than your expectations, you’d probably be pretty impressed. This is what happened with Nvidia and their Q2 earnings report. To take it a step further, they also raised forecasts slightly ahead of expectations and the company assumed zero business from China. So, despite many who seem to be crying again that the spending on AI is over, earnings reports and future spending outlooks by Amazon, Microsoft, Meta, Alphabet and Nvidia’s earnings all say there is a lot more to expect ahead. To put this into perspective, the amount of money that is being spent on AI buildout just by Amazon, Microsoft, Meta and Alphabet for 2024 and 2025 equals the total amount they spent together over the preceding 9 years as you can see in the chart below:

Gartner Research and TechMonitor.com both estimate tech spending will increase by another 27% in 2026. While this is very positive news for the group of stocks that are receiving this spending, (e.g. Nvidia as one example), some are benefiting more than others.

I’ve written before about the difference between machine learning and inferencing, and we are now entering the second phase of AI, which is inferencing. This will impact and change how and where tech spending goes. For those who did not correctly navigate the past two-plus years, the transition to inferencing could provide another wave for investors to try to ride. Historically, when spending trends change, there is increased volatility and tumult during the transition. In that volatility and tumult we can find potentially big opportunities. From my vantage point, 2025 appears to be where the next transition began. Praise God, we have ridden this wave well the past two years. This, of course, does not mean we will be able to do so. This is why I let the data tell me how to zig and zag rather than guessing bottoms and tops.

Putting this all together and looking ahead, I continue to believe, as I’ve written in the past two Market Updates, that I think there could be a swift sell-off like March (2025), I believe it may be to a lesser extent, barring some major geopolitical surprise. So, it may be prudent to take some gains from the recent strong rally. This does not mean sell your winners blindly, rather like cutting off unfruitful branches on an apple tree and pruning those that are fruitful to make the whole (portfolio) more fruitful. I remain confident in my outlook due to the tailwinds for stocks still in place: interest rates bound in a tight range, technological spending forecasts remain robust, and inflation staying within a tight range, with corporate cash flows also generally robust. But like in the story of ‘The Boy Who Cried Wolf,’ eventually there really was a wolf, so I remain vigilant in assessing data and trends to try to ensure I don’t fall victim to the eventual wolf in the markets.

My team and I remain honored and grateful to be your advisor. Please contact us at your convenience with any questions or should you wish to discuss our positioning and outlook in more detail.

Opinions expressed are that of the author and are not endorsed by the named broker/dealer or its affiliates. All information herein has been prepared solely for informational purposes and should not be considered legal or tax advice. It is not an offer to buy, sell, or a solicitation of an offer to buy or sell any security or instrument to participate in any particular trading strategy and is not intended to provide, & should not be relied on for, tax, legal or accounting advice. You should consult your own tax professional regarding your specific situation. Past performance does not guarantee future results. Certain statements contained within are forward-looking statements including, but not limited to, statements that are predictions of future events, trends, plans or objectives. Undue reliance should not be placed on such statements because, by their nature, they are subject to known and unknown risks and uncertainties. Oxford Retirement Advisors is an independent firm with Securities and Advisory services offered through Madison Avenue Securities, LLC (“MAS”), member FINRA/SIPC and a Registered Investment Advisor. Oxford Retirement Advisors and MAS are not affiliated entities.